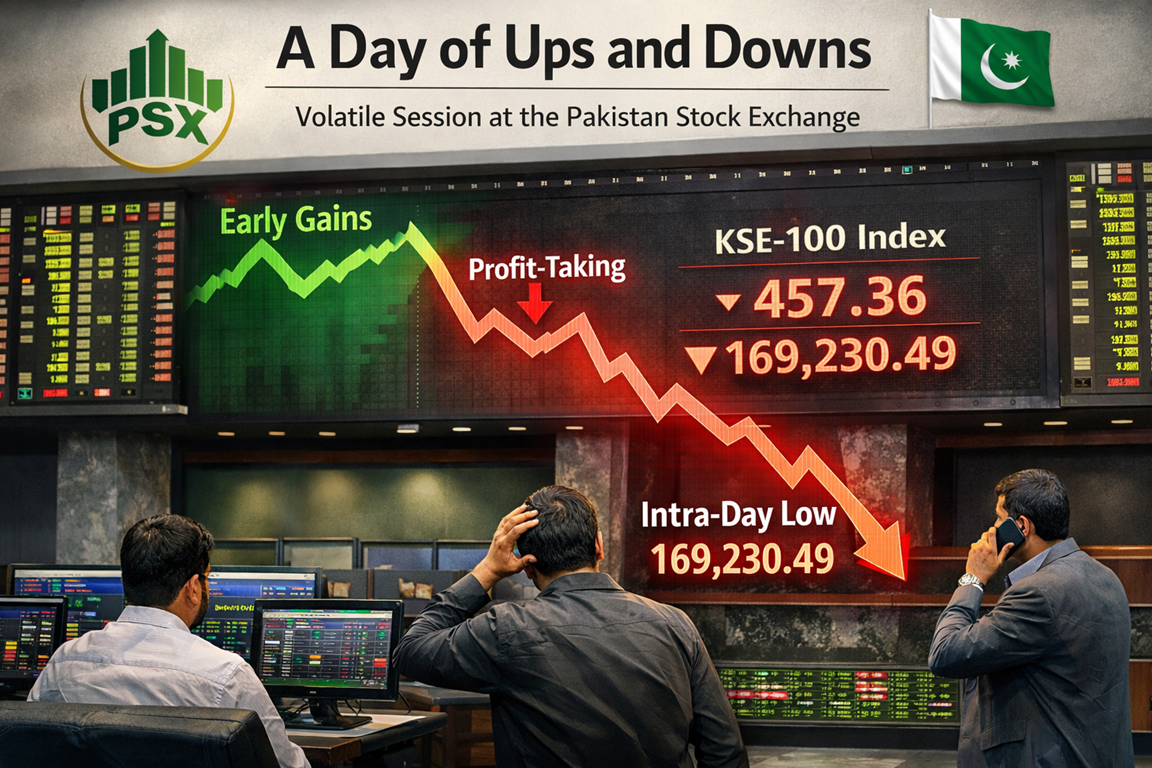

The Pakistan Stock Exchange (PSX) experienced a range-bound and volatile trading session on Wednesday, with the benchmark KSE-100 Index ending marginally in the red after swinging between gains and losses throughout the day.

🔄 A Day of Ups and Downs

Trading began on a positive note, lifting investor sentiment early on 📈. However, profit-taking in heavyweight stocks quickly erased most of the gains by mid-session, pushing the index to an intra-day low of 169,230.49.

Although some recovery was seen later in the day, selling pressure dominated, and the benchmark index finally closed at 170,313.85, down 133.44 points (0.08%).

🇵🇰 Positive Economic Signal: Current Account Surplus

Amid the cautious trading, there was some encouraging macroeconomic news. Data released by the State Bank of Pakistan (SBP) showed that Pakistan recorded a current account surplus of $100 million in November 2025 💰.

The surplus was primarily driven by a significant reduction in imports, helping ease external account pressures.

📊 Previous Session Also Ends in Red

The cautious mood followed a weak previous session, where broad-based selling outweighed early optimism. On Tuesday, the KSE-100 Index slipped 294.05 points (0.17%) to close at 170,447.30, leaving investors wary despite improved liquidity and active participation across sectors.

🌍 Global Markets: Mixed Signals from the US

International markets also remained cautious. Global equities drifted as a mixed US jobs report failed to provide clear direction on future interest rate cuts.

While job growth rebounded in November after a sharp October decline, the unemployment rate rose to 4.6%, the highest level in over four years 📉. Analysts noted that the data was distorted by the US government’s record 43-day shutdown, adding noise to the figures.

🌏 Asia and Wall Street Snapshot

- MSCI Asia-Pacific ex-Japan Index: +0.24% 📊 (boosted by Chinese stocks)

- Japan’s Nikkei: +0.35% 🇯🇵

- Nasdaq & S&P 500 futures: Flat ⚖️

Despite the mixed data, markets are still pricing in around two US rate cuts next year, with the latest labour report doing little to shift expectations.

👀 What’s Next?

Investors are now turning their attention to a crucial upcoming event — the US November inflation report, due on Thursday 📅. The data could offer clearer signals on the future direction of global interest rates and market sentiment.