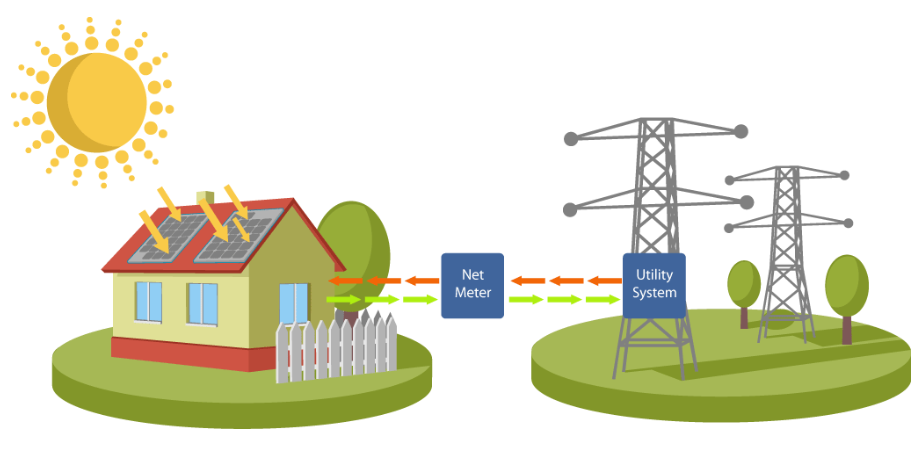

Pakistan’s solar net-metering landscape is set for a major shake-up as the National Electric Power Regulatory Authority (Nepra) has released draft Prosumer Regulations 2025, inviting public feedback over the next 30 days before formally repealing the 2015 net-metering regulations.

The proposed changes significantly reduce the size, contract duration, and compensation rates for net-metered solar consumers — a move widely seen as an effort to shield the struggling and costly grid-based power sector from further erosion.

What’s Changing in Net Metering?

At the heart of the proposal is a recalibration of what Nepra calls a “balance” between utilities and consumers. While the regulator acknowledges that solar allows households and businesses to hedge against rising electricity prices, it has made it clear that net metering should no longer function as a profitable venture.

Under the new framework, prosumers — consumers who also produce electricity via solar — will no longer be allowed to install solar capacity beyond their sanctioned load. This effectively cuts allowable system size by 50 percent.

For example:

- A consumer with a 10kW sanctioned load will now be allowed to install only a 10kW solar system

- Previously, the same consumer could install up to 15kW under the 150% rule

Existing net-metering customers, however, will remain unaffected until the end of their current seven-year contracts, after which the new rules will apply.

Shorter Contracts, Lower Payments

One of the most impactful changes is the reduction in contract duration. New net-metering agreements will now be limited to five years instead of seven, with the option to renew for another five years — but only with mutual consent and no automatic obligation.

Even more consequential is the proposed cut in compensation for surplus electricity. Prosumers will now be paid the National Average Energy Purchase Price (NAEPP) — estimated at around Rs13 per unit — for excess power supplied to the grid. This is roughly half of the current rate, which stands at about Rs26 per kilowatt-hour.

Context: A Grid Under Pressure

Ironically, Nepra recently acknowledged that the quality of service provided by distribution companies (Discos) remains “sub-optimal.” High taxes, levies, and surcharges — particularly debt servicing charges — have pushed electricity tariffs to unaffordable levels, driving consumers toward solar and off-grid solutions.

According to Nepra, on-grid solar capacity has already crossed 6,000MW, while total solar installations, including off-grid systems, exceed 13,000MW. This rapid shift has significantly weakened grid demand, further straining an already inefficient power sector.

Stricter Technical and Procedural Controls

The draft regulations also introduce stricter technical standards and clearer timelines to better manage distributed generation and protect grid stability.

Key procedural changes include:

- Standardized application forms

- Discos required to provide Nepra-approved documents free of cost within two working days

- Applications to be acknowledged within five working days

- Missing documents to be submitted within three working days

A major new restriction is the introduction of a transformer-level capacity cap. Discos will be prohibited from approving new net-metering connections once distributed generation connected to a transformer reaches 80 percent of its rated capacity, in order to prevent overloading and technical failures.

Additional Scrutiny for Large Installations

For larger systems — 250kW and above — applicants will be required to submit a load flow study, conducted either by the Disco or a Pakistan Engineering Council–registered consultant. Discos will have 15 working days to complete their technical assessment and either approve or reject the application, with both outcomes reported to Nepra.

Once an agreement is signed:

- Connection cost estimates must be issued within seven working days

- Prosumers must pay charges within seven working days

- Discos must install and commission interconnection facilities within 15 working days

What This Means Going Forward

The proposed regulations mark a decisive shift in Pakistan’s renewable energy policy — from incentivizing rapid solar adoption to tightening controls and limiting financial returns. While the government argues this is necessary to stabilize the grid, critics warn it could slow solar growth at a time when consumers are increasingly seeking relief from high electricity prices.

With public feedback now open, the coming weeks will be crucial in determining how Pakistan balances its renewable energy ambitions against the realities of a fragile power sector.